Simple Markowitz Portfolio Optimzation Problem

problem-markowitz.RmdHere we solve a simple Markowitz Portfolio Optimization Problem. I really have no idea about security selection, but it is a good example of a continuous quadratic program.

The model

This example follows the formulation from here.

We have a number of \(n\) stocks. Each has an expected value of \(e_i\) and a covariance matrix \(C_{i,j}\). The question is now: can we construct a portfolio of stocks that gives us at least a return of \(\mu\) but with minimal variance? In order to do this we seek weights for our stocks that minimize the risk while giving us a lower bound on the expected return.

\[ \begin{equation*} \begin{array}{ll@{}ll} \text{min} & \displaystyle\sum\limits_{i=1}^{n}\sum\limits_{j=1}^{n}C_{i,j} \cdot x_{i} \cdot x_{j} & &\\ \text{subject to}& \displaystyle\sum\limits_{i=1}^{n} e_i \cdot x_{i} \geq \mu& &\\ & \displaystyle\sum\limits_{i=1}^{n} x_{i} = 1& & \\ & 0 \leq x_{i} \leq 1 &\forall i=1, \ldots, n & \end{array} \end{equation*} \]

In R

First we generate some data

set.seed(42)

n <- 10

returns <- matrix(

rnorm(n * 20,

mean = runif(n, 0.01, 0.03),

sd = runif(n, 0.1, 0.4)),

ncol = n) # 20 time periods

# each col is a stock time series

e <- colMeans(returns)

C <- cov(returns)

min_mu <- 0.02

library(rmpk)

library(ROI.plugin.quadprog)

solver <- ROI_optimizer("quadprog")

model <- optimization_model(solver)

x <- model$add_variable("x", i = 1:n, lb = 0, ub = 1)

model$set_objective(sum_expr(2 * C[i, j] * x[i] * x[j], i = 1:n, j = 1:n))

model$add_constraint(sum_expr(e[i] * x[i], i = 1:n) >= min_mu)

model$add_constraint(sum_expr(x[i], i = 1:n) == 1)

model$optimize()

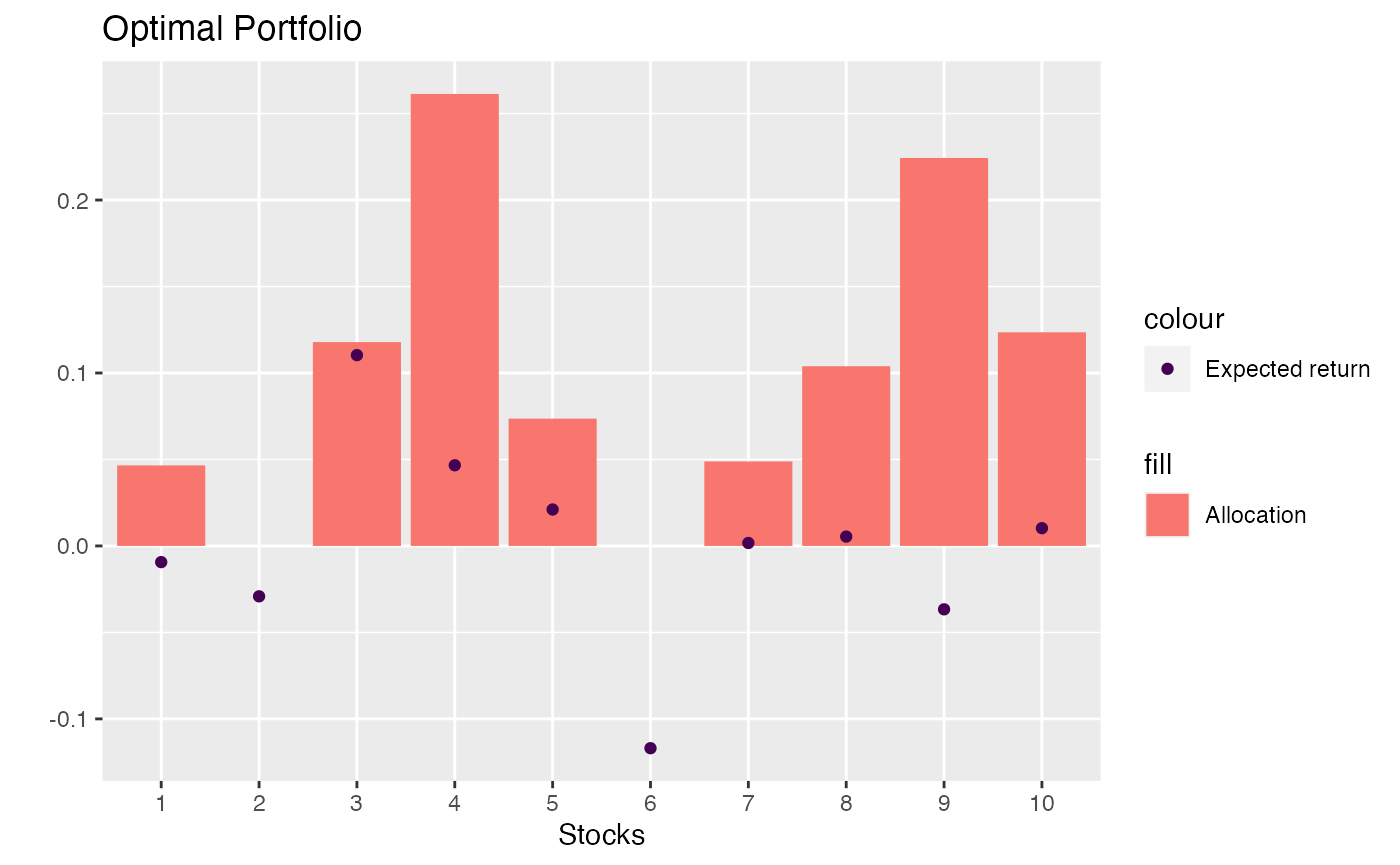

(results <- model$get_variable_value(x[i]))

#> name i value

#> 1 x 1 4.656654e-02

#> 2 x 7 4.886324e-02

#> 3 x 5 7.361526e-02

#> 4 x 8 1.039045e-01

#> 5 x 2 3.285331e-18

#> 6 x 10 1.235237e-01

#> 7 x 9 2.243257e-01

#> 8 x 3 1.178596e-01

#> 9 x 6 -1.248999e-18

#> 10 x 4 2.613414e-01

library(ggplot2)

ggplot(results) +

aes(x = factor(i), y = value) +

geom_bar(stat = "identity", aes(fill = "Allocation")) +

geom_point(data = data.frame(i = factor(1:n), value = e), aes(color = "Expected return")) +

xlab("Stocks") +

ylab("") +

scale_fill_discrete() +

scale_color_viridis_d() +

ggtitle("Optimal Portfolio")

Bars are stock allocation and dots are the expected returns. It is a bit strange that the model allocates 20% of our portfolio to a stock with negative expected return - but maybe it reduces the volatility… or it is a bug :)

Feedback

Do you have any questions, ideas, comments? Or did you find a mistake? Let’s discuss on Github.